what will.happwn if i dont make payments to aarons or return the peoperty im renting to own

This guide contains everything yous need to know to buy an apartment building, and decide if it'due south a good investment for y'all.

For most new investors, ownership an apartment edifice might seem similar a daunting chore that's too difficult or expensive to achieve. I used to retrieve that myself, until I closed on my start 12 unit apartment building, and realized that the whole process isn't that much different than the process I'd already learned to buy a smaller rental belongings. The biggest benefit is the scale - with one purchase I was able to double my portfolio, while buying an asset with many tenants to mitigate the risk of a few vacant units pain my cash flow.

While the barrier to entry may seem high, as some flat complexes do require down payments of $100,000 or more than, not all apartments are that expensive. There are also some creative financing options that nosotros'll discuss that let you purchase an apartment with a downwards payment that'south far less than you lot might have thought was possible. In some cases you tin really purchase with no coin downwards.

JUMP TO Section

- Is Ownership An Apartment Building A Good Investment?

- How Much Does Buying an Apartment Building Typically Cost?

- How Much Coin Tin You Brand Owning an Flat Complex?

- 12 Steps To Buy An Flat building

- Pros of Investing in an Apartment Building

- Cons of Investing in an Flat Edifice

- Case Study - Buying a 12 unit of measurement flat edifice

- 5 Pro Tips To Buying An Apartment Edifice

- Top FAQs About Buying an Apartment Building

- Where practice I find apartment buildings for sale?

- How exercise you value an apartment complex?

- How do you lot finance an apartment building?

- How tin I buy an investment property with no money down?

Is Buying An Apartment Building A Skillful Investment?

The important thing to consider when making whatever investment is the risk-adjusted return — the amount of money you can hope to make in the face of the take a chance you lot take on. Overall, apartment buildings have a nifty take a chance-adjusted return, but this varies for each private belongings, usually based on the purchase cost that yous're able to buy the apartment for.

In short: apartment buildings in general are practiced investments, but non every individual apartment edifice is a good investment. Would-exist investors must practise circumspection when evaluating a property and take into business relationship many factors including the condition of the property, price relative to other similar backdrop, local real manor trends, rental vs. ownership demand in the area. The easiest style to do this is with a rental property calculator that lets you lot forecast the returns you can wait from purchasing a particular apartment circuitous

Even so, people e'er demand a place to live, and renting an apartment is ofttimes the most affordable housing selection. At that place is currently a shortage of affordable housing in most american cities, which bodes well for owners of flat complexes that offer affordable to mid level housing. On the other hand, there is currently a large amount of new luxury apartments being built, and those will be the start to reduce rent or go vacant if the economy dips.

How Much Does Buying an Apartment Edifice Typically Cost?

The boilerplate cost of buying an flat building really depends on what you define as an apartment building. If y'all consider buying a duplex, triplex, or fourplex and apartment building, than the average toll goes downwardly drastically. In my marketplace I can buy a fourplex that cash flows for effectually $100,000, and if I was willing to live in the property I could use an FHA loan and business firm hack by living in i of the units for merely 3.five% downwards.

Banks will finance anything that'due south iv units or less with a residential mortgage, and annihilation over 4 units you lot will need a commercial loan. Personally, I draw the line in a similar fashion to the banks, and consider anything four units an nether a "small apartment building", and anything larger more than of an "flat circuitous."

Flat complexes tin be tens of millions of dollars or more than if you're ownership huge high rises with 100s of units. Nonetheless, there is a middle of ground of smaller apartment complexes that are bigger than a 4plex, just nonetheless affordable plenty for nearly investors.

The table below shows the boilerplate cost yous can expect to pay for an apartment edifice. Annotation that well over 50% of all apartment buildings sold for less than $ane,000,000 in the last 12 months.

| Values and sold prices (last 24 months) | United States |

| Average toll/sqft | $1,684 |

| Boilerplate sold cost | $one,598,091 |

| Median sold price | $238,400 |

| Number of sales | 329,305 |

| Number of sales over $250k | 160,131 |

| Number of sales over $1m | 46,669 |

| Number of sales over $10m | 7,659 |

| Boilerplate total tax amount | $31,708 |

| Boilerplate assessed value | $758,959 |

| Average market place value | $1,205,696 |

Data from Reonomy

How Much Coin Can You Make Owning an Flat Complex?

At that place are iv primary ways to make money owning an apartment complex:

- Rental Income- After you embrace all of your expenses - what you accept left over is cash menstruation that you lot tin spend as you lot please

- Property Appreciation - This is often where the bulk of the money is made, as apartment buildings take been growing in value rapidly in the last x years. Some investors are even willing to buy a building that simply breaks fifty-fifty on cashflow with hire, considering they are confident they will make a bang-up return on their investment with appreciation.

- Leverage - If you borrow a million dollars from the banking concern four%, and employ information technology to purchase an apartment complex with an eight% cap rate (return on investment) - you can profit off the departure. If you lot practise this with millions of dollars, you can generate a tremendous return.

- Taxation Benefits - Real estate is one of the about tax advantaged investments, as you're able to depreciate your investments, and write off the interest you pay in your mortgage.

You can learn more than near the 4 ways to generate income from real estate in our real manor investing guide

When it comes to how much money you tin make from investing in apartment buildings, it depends on how big on an investment you brand. More often than not speaking, you can look between a 4-10% cap rate when yous purchase an apartment.

Pros of Investing in an Apartment Building

- Loftier earning potential: You tin can grow your portfolio faster by buying one large apartment than you can with single family unit rentals.

- Dependable greenbacks flow: Apartment buildings provide a reliable income stream. If some of your units are vacant or tenants aren't paying, you even so have other units that are paying that cover your expenses.

- Appreciating nugget: Similar all real estate, flat buildings are an appreciating asset. If you no longer desire to run your complex, you can sell information technology for a profit after a few years.

Cons of Investing in an Apartment Building

- Harder to diversify your market exposure: Apartment buildings can exist expensive, and it's hard for new investors to purchase a lot of them. This means that it's difficult to diversify your portfolio in different market place classes.

- Higher turnover rate: Single-family unit backdrop usually have longer-term renters. Since flat buildings have to deal with more resident turnover, owners demand to spend more time finding new renters, and doing brand-readys to become their units gear up for new residents.

- Large down payment: Buying an apartment building usually isn't cheap and ofttimes requires a hefty downward payment. The required down payment for a multi-family unit property is normally higher than the downward payment for single family rental properties.

12 Steps To Buy An Apartment building

If you're looking to buy an flat complex - y'all can follow this 12 pace guide:

- Prepare Your Goals - If you don't know where y'all're going, you will never get there. Ask yourself what you want to achieve from owning an apartment circuitous, then work backwards to figure out how much income you need to generate.

- Set Your Budget - Establish an amount that y'all're willing to spend buying an apartment complex. Brand sure you get out enough cash on paw for repairs, and keep your portfolio various. It'due south not a not bad thought to put over 50% of your investment portfolio in one property.

- Acquire how to forecast cash menses - This is where the renal belongings calculator nosotros mentioned higher up comes in handy. You should exist able to model prospective deals and then y'all know where to focus your fourth dimension and energy.

- Choose a marketplace - I recommend that yous start by looking in your local market and modeling a few deals to see if it'southward feasible, before you offset looking out of state. Its much easier to manage something you can drive to, and you can be more confident that you understand the dynamics of the neighborhood.

- Get Pre Approved For Financing - Talk to 3+ different lenders and compare their different products and rates. It'south a good idea to get pre approved with at least ii, then you can go detailed quotes to compare in one case you detect your property.

- Start looking for backdrop - You can look on the MLS, Loopnet and other commercial real manor websites, besides equally networking with brokers that have off marketplace backdrop. You can learn 5 tips to find slap-up deals here.

- Outset making Offers - Remember not to get emotional! These are investments, and you should only offer a number that makes sense for yous, fifty-fifty if information technology's drastically lower than the list price.

- Inspections- Make sure your apartment complex is in the same condition it was advertised in. Be sure to check the roof, HVAC, plumbing, and electrical systems, as those can be the most expensive if they need repairs.

- Cull a belongings management company - The management company yous cull volition make or break your investment, so be certain to interview at least three companies, and hear real reviews from some of the current owners they manage property for.

- Locking in your financing - Go back to the aforementioned lenders that got you lot pre approved, and bring the actual deal yous found and so you lot can compare rates. Option a lender, and they will have your personal financial statement, and go you fully approved.

- Closing day - Congratulations! Go ready to sign a ton of paperwork, then accept a moment to celebrate your accomplishments.

- Growing your portfolio - Once you've stabilized your investment and are generating cash flow, it'southward time to repeat this process, and start looking for your next investment!

For a more detailed explanation, yous can read our detailed guide on how to buy investment property.

Instance Report - Buying a 12 unit of measurement apartment building

The movie higher up isn't pretty - but it's probably the best investment my partner and I have made to appointment. This is a 12 unit of measurement apartment circuitous that my partner and I bought a few years ago in rough shape, and brought it back to life.

Nosotros purchased the edifice from an investor that had recently saved the edifice from beingness boarded up, only didn't do much more than than that. The units were in crude shape and had structural issues, leaking roofs, sewer issues, and damaged interiors.

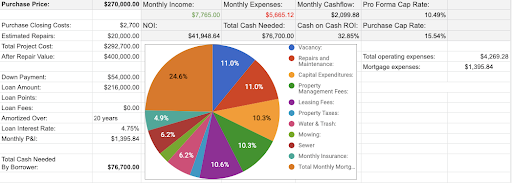

We bought the entire complex for effectually $270,000, or $22,500 per door. The moment we closed we had our crew come in and put on new roofs, fixed the sewers, redid the tuckpointing, and started renovating the apartments every bit they became vacant (iii units were vacant, and 2 tenants weren't paying). Over the next year we completed the renovations, and raised the boilerplate rent from $550 to $650. By our calculations, we've increased the value of this flat complex by over 100%, as we currently value this property at $600,000, and information technology simply price about $130,000 in renovations to get there.

This property now generates over $two,000 in cash flow for united states of america after covering all our expenses.

5 Pro Tips To Ownership An Flat Building

Convinced that an flat complex is the right investment for you? Here's 5 pro tips to help make the buying process move along smoothly.

i. Partner with an experienced real estate agent

When it comes to ownership apartment complexes, a lot of the best properties never hit the market place, and are sold by agents with connections to their clients that they know tin close.

If you're serious about buying an apartment building, you need to get an amanuensis that'due south focused on investors, and has access to a lot of sellers that desire to sell, but don't want to list their properties on the market. If yous're not sure where to find ane of these agents, Clever tin aid.

Connect With An Experienced Agent To Purchase an Apartment

Clever can match you with top agents that focus on apartments!

2. Choose your belongings type

There are quite a few different types of apartment buildings: loftier-rises, mid-rises, garden-style, and walk-ups, among others. Brand sure to evaluate the current existent manor trends in your area before deciding which type to buy as popularity will vary past region. You lot real estate amanuensis tin can brand recommendations based on what they see in their day-to-mean solar day work.

Yous as well demand to decide if you want a new apartment complex or i that volition require some fixing up. Fixer-uppers can generally be establish for a improve bargain, but require a greater time investment and a keen center for undervalued backdrop.

iii. Visit multiple properties and practice your homework

Don't buy the first property y'all run across. Look into local demand, perform an inspection to get an idea of the condition of the house, and visit as many properties as possible.

The ratio of renters to owners in a region can be a good indicator of your investment's success probabilities. Cities with more renters than owners volition have more demand for apartments, then be sure to look into these statistics earlier making a purchase.

4. Empathise the financial process and run the numbers

To buy an investment holding, you'll have to make a twenty% down payment, and you lot'll too need to pay for insurance, mortgage payments, maintenance and management costs, and marketing expenses.

Upkeep expenses tin accept a big seize with teeth out of your lesser line. Prior to buying a complex, expect up the local going rate for some of the nearly mutual renovations similar repainting the outside of the building and the interior of the apartments for when tenants move out.

Make sure that after all these expenses, you'll notwithstanding be in the black. There'due south no worse situation to be in than owning a multi-million dollar apartment complex that loses y'all money every month.

5. Choose the correct lender

At that place are three common types of loans for apartment buildings (not counting residential loans for buildings smaller than 4 units:

- Authorities-backed Apartment Loans: These loans offering high LTV (loan-to-value) ratios and have a range of $750,000 to $half-dozen one thousand thousand. Fannie Mae, Freddie Mac, and the FHA offer this blazon of loan. Typical rates are three.5-6%.

- Bank Balance Sheet Apartment Loans: Many local lenders love making loans to investors to buy apartments. You lot tin wait loan terms of 20-25 years, with airship payments ranging from 3-15 years, and involvement rates betwixt 3-half-dozen%

- Brusk-Term Apartment Financing Options: These loans are meant to aid investors compete with cash buyers by offering mortgages on short discover. Minimum loan amounts are $100,000, with LTVs upward to 90%. Rates are high at 7.5-12%.

Once you lot've decided what type of loan is right for you, brainstorm researching each individual lender'due south offerings. Each banking concern and lender is dissimilar, and so be sure to pore over all your options. A small-scale charge per unit increase can eat into your profits.

Top FAQs Virtually Ownership an Apartment Building

Where do I find apartment buildings for sale?

Working with a real estate agent is the all-time style to find apartment buildings for sale. They can utilize their professional network and the MLS to monitor new listings and warning you of suitable backdrop for auction. Besides a existent manor agent, you can find listings in the local paper and online.

How do you lot value an apartment complex?

There are three ways to value an apartment building: the sales approach, the replacement approach, and the income approach. Of these, the income approach is the nigh common.

To determine an apartment's value using the income approach, start past finding the NOI. Multiply the monthly rent per unit by the number of units in the edifice and subtract all operating expenses. Side by side, divide the NOI past the cap rate that's common in the backdrop location. You tin can observe the cap rate by speaking with real estate agents in your surface area.

As an case: if the NOI on the property is $30,000 and the cap rate is 0.12, the value of the holding is $250,000.

How do you lot finance an apartment building?

To finance an apartment building, y'all need to observe a lender that offers government-backed loans, banking concern residuum sheet loans, or brusk-term financing options. The rates and maximum loan amounts vary depending on the type of loan. Compared to residential belongings lenders, commercial existent estate lenders are more likely to base lending decisions on an applicant's real estate investment experience.

How can I buy an investment property with no coin down?

In some cases, sellers are willing to offering seller financing for the unabridged purchase, or enough to cover the down payment with a commercial lender. Personally, I've had several sellers be willing to owner finance our down payment for 3-v years and then we tin can refinance, merely accept yet to accept a seller agree to owner finance the entire holding.

Related Articles

You lot May As well Like

Source: https://listwithclever.com/real-estate-blog/beginners-guide-to-buying-an-apartment-building/

0 Response to "what will.happwn if i dont make payments to aarons or return the peoperty im renting to own"

Post a Comment